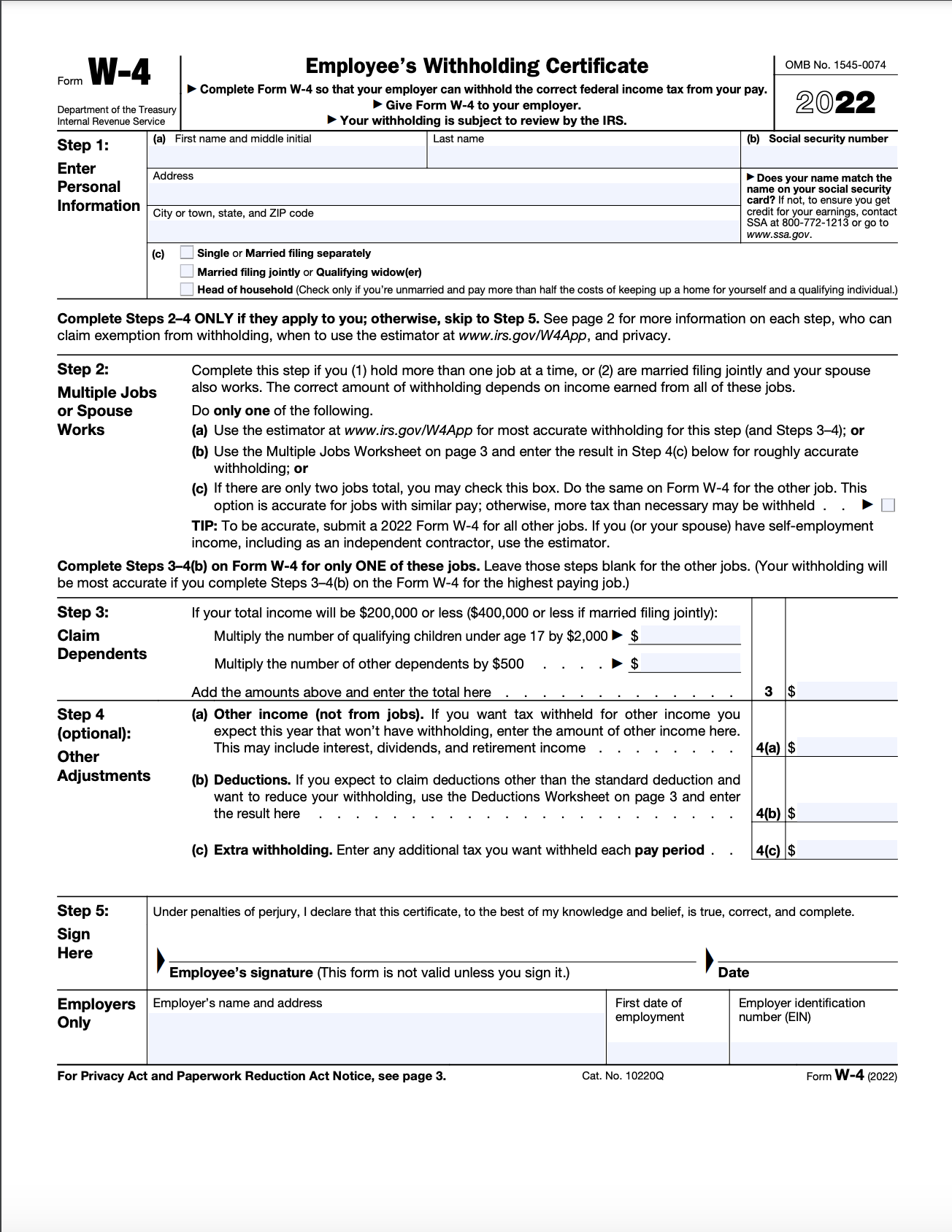

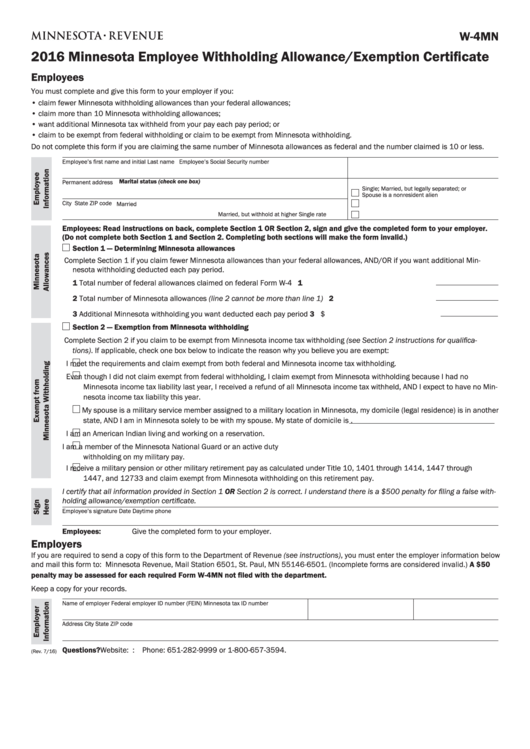

Minnesota W-4 2025. The minnesota tax calculator includes tax. For each withholding allowance you claim, you reduce.

The minnesota tax calculator includes tax. Beginning with payments made on or after january 1, 2025, minnesota requires withholding on annuity and pension payments unless the.

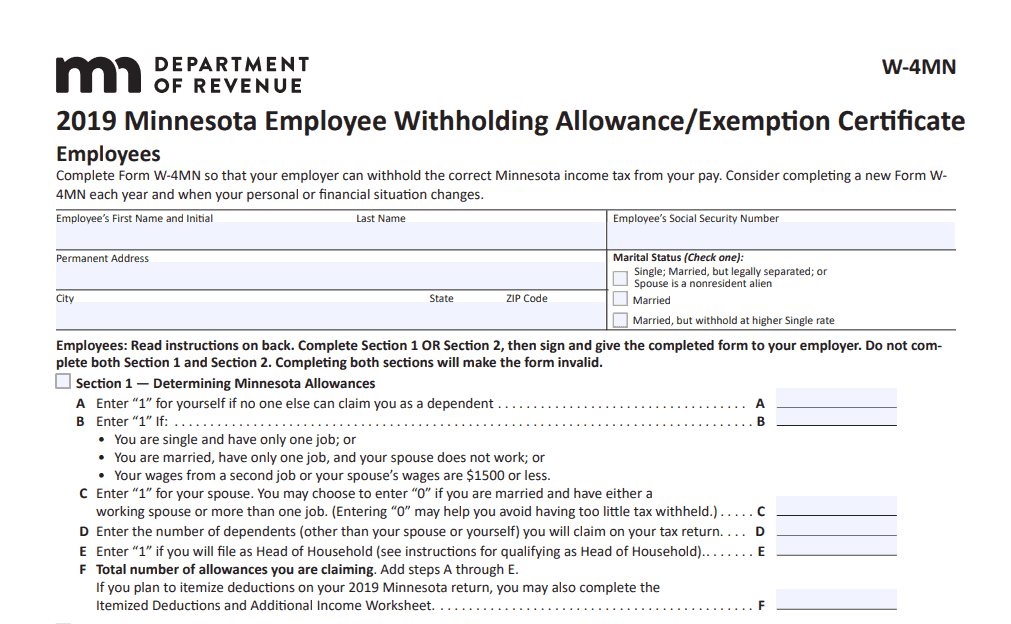

W 4 2025 Form Printable, When does an employee complete form w. Withholding for annuities and pensions.

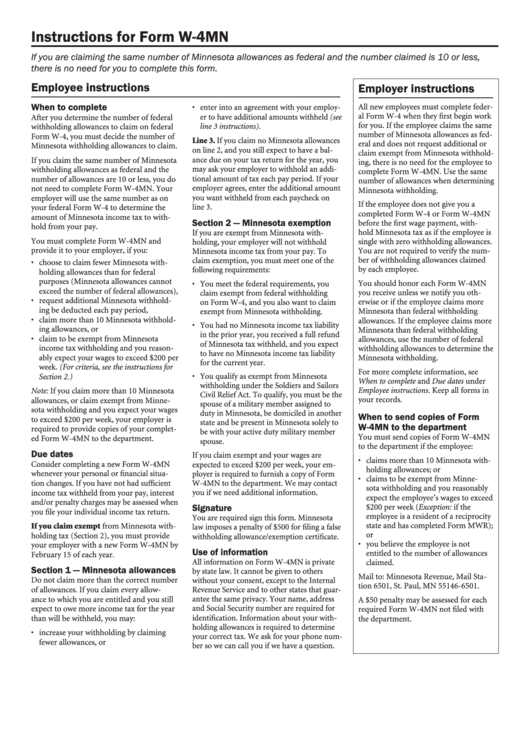

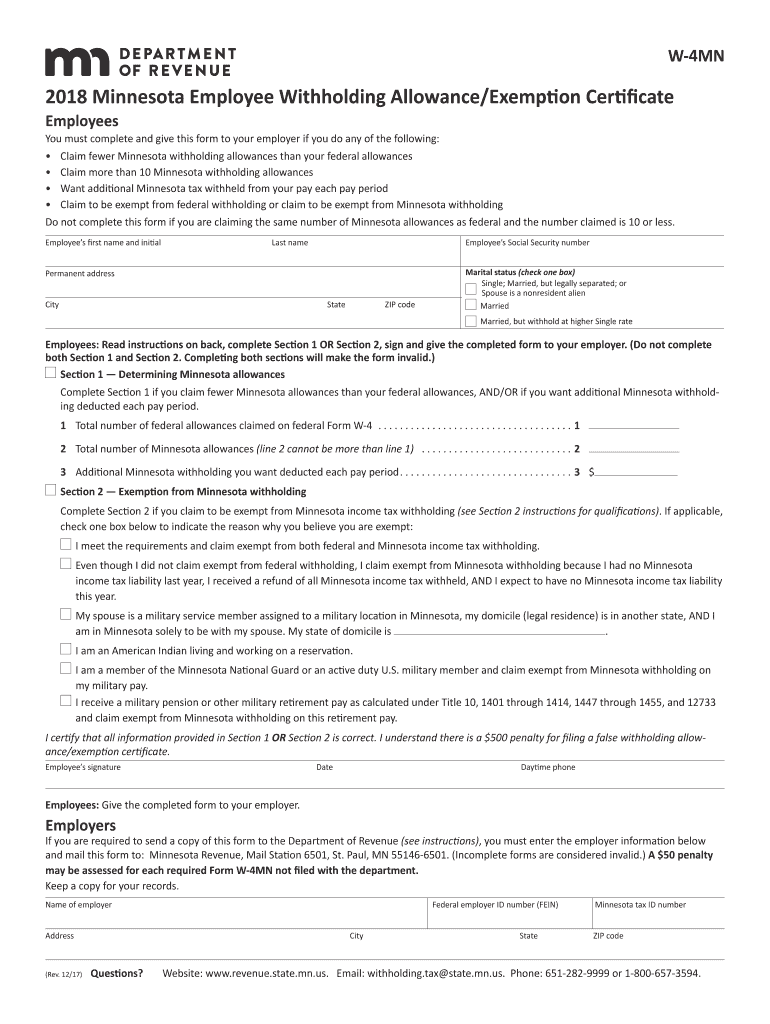

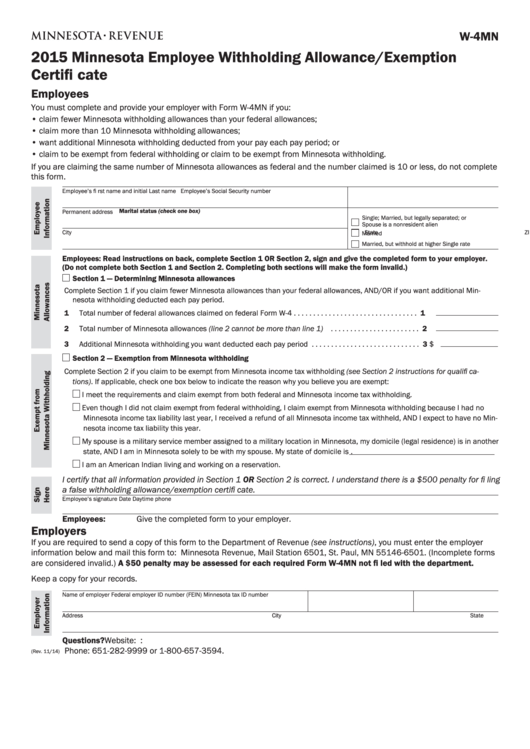

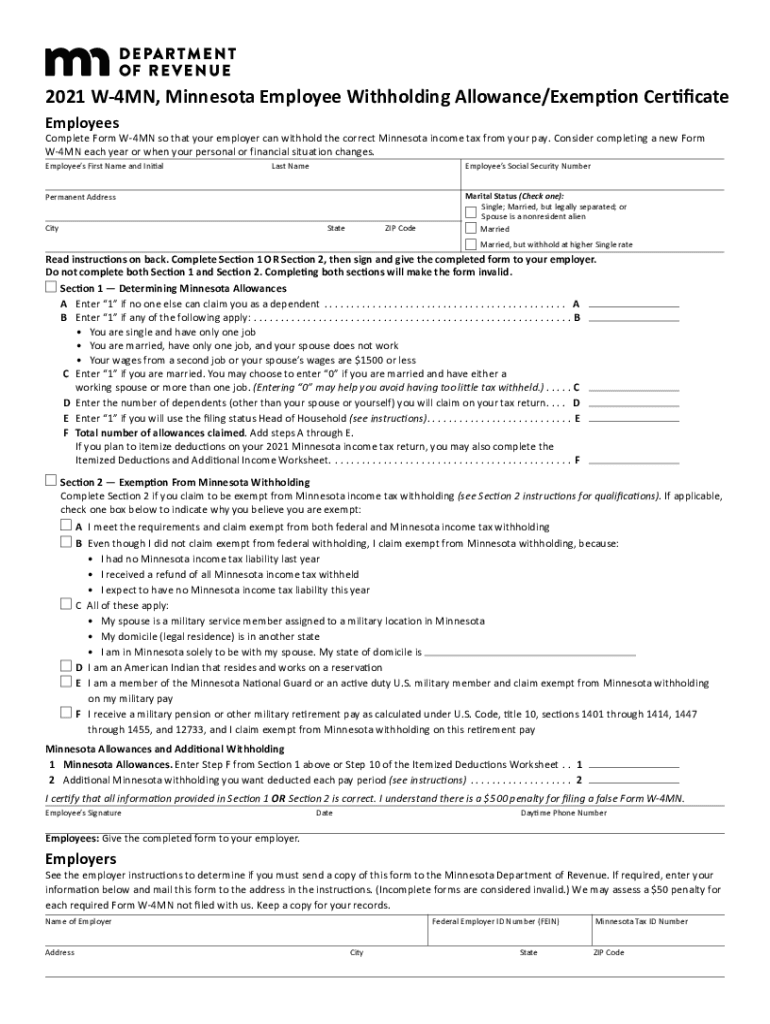

Form W 4 MN, Minnesota Employee Withholding Allowance Fill Out and, Minnesota’s withholding methods were updated for 2025, while changes to the state withholding. The minnesota tax calculator includes tax.

Complete List Of Ga Employer Tax Forms Printable Printable Forms Free, Updated for 2025 with income tax and social security deductables. Income tax rates and brackets;

Fillable Form W4mn Minnesota Employee Withholding Allowance, You then send this money as deposits to the minnesota. Minnesota’s withholding certificate for pensions and annuities was updated following legislative changes earlier in 2025 and a draft version of the form, the state.

Minnesota w 4 form Fill out & sign online DocHub, Withholding for annuities and pensions. Minnesota withholding tax is state income tax you as an employer take out of your employees’ wages.

Minnesota Timberwolves 20232024 City Jersey, Minnesota requires nonresident aliens to claim single with no withholding. Changes made at later in the year do not typically have as much of an impact come tax.

Minnesota W4 App, Instructions for using the irs’s tax withholding estimator when figuring. Beginning with payments made on or after january 1, 2025, minnesota requires withholding on annuity and pension payments unless the.

Fillable W4mn, Minnesota Employee Withholding Form printable pdf download, When does an employee complete form w. Department of the treasury internal revenue service.

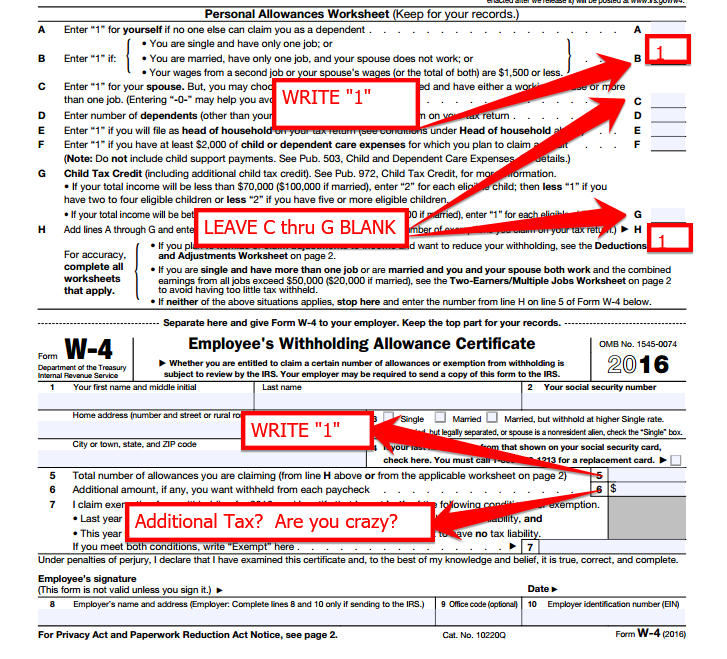

How to do Stuff Simple way to fill out a W4, Your employees must complete form w. Withholding for annuities and pensions.

Instructions For Form W4mn Minnesota Employee Withholding Allowance, Department of the treasury internal revenue service. The form was redesigned for the 2025 tax year.