Ctc Increase 2025 Irs. Ctc payments 2025 irs update in 2025 the irs is expected to make a $300 direct deposit payout on the 15th of each month to those who are under 6 and those who aged 6 to 17. Washington — senior lawmakers in congress announced a bipartisan deal tuesday to expand the child tax credit and provide a series of tax breaks for.

The irs is urging taxpayers not to wait to file their 2025 tax returns in anticipation that congress could pass the expanded child tax credit. Washington — the house voted wednesday night to pass a $78 billion tax package that.

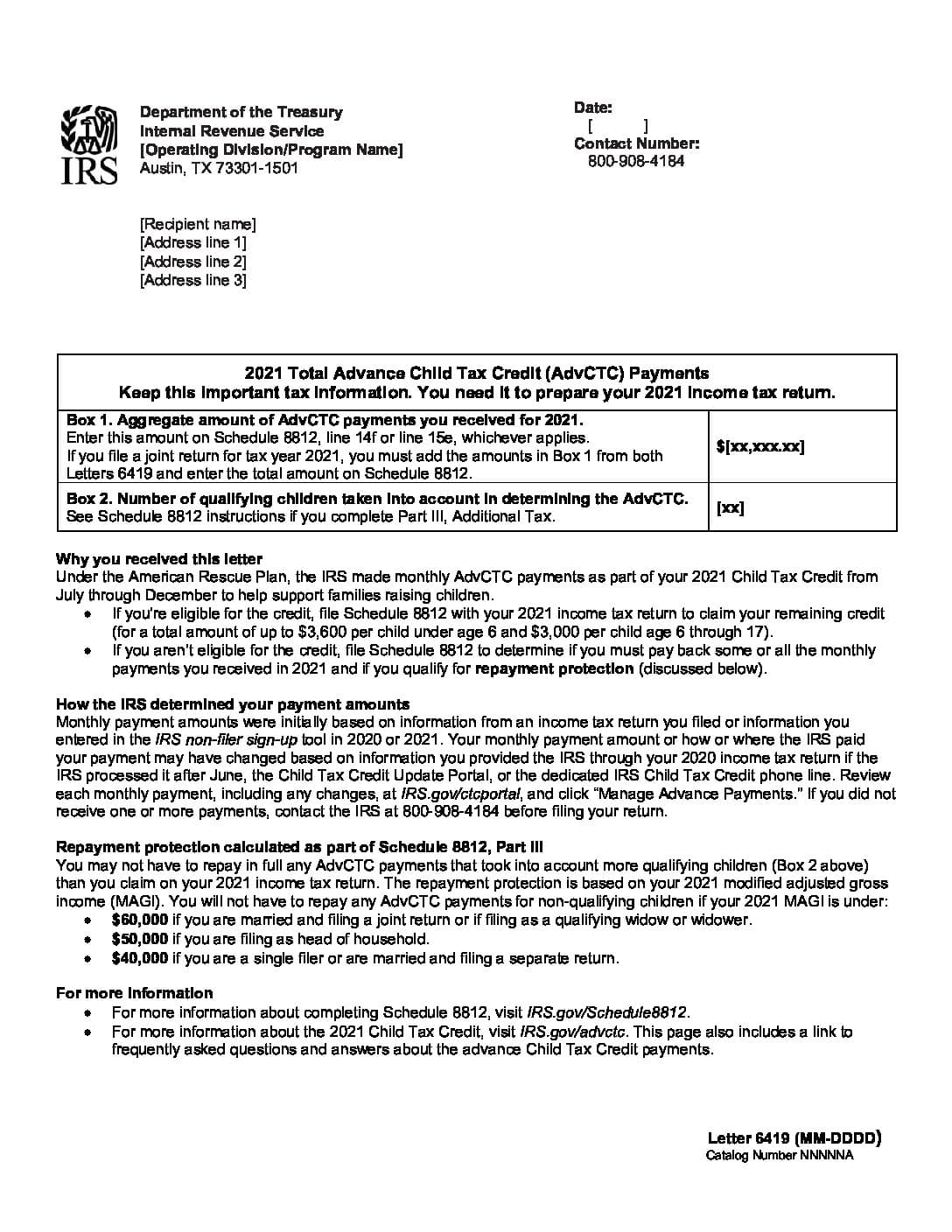

Ctc For 2025 Irs Reyna Clemmie, The house passed the tax relief for american families and workers act of 2025, introducing. The child tax credit (ctc) is a federal tax benefit that provides financial support for taxpayers with children.

When Will Ctc Refunds Be Issued 2025 Ava Meagan, $8700 stimulus checks 2025 payment dates the proposed $8700 stimulus checks 2025, termed to be a part of the expanded child tax credit (ctc) program in. To tackle poverty, more states will offer bigger child tax credits in 2025.

IRS announces higher retirement account contribution limits for 2025, The new bill raises the maximum refundable amount to $1,800 for the 2025 tax year, $1,900 in 2025, and $2,000 in 2025. Enhancements to the child tax credit:

Irs Ctc Refund Dates 2025 Cyb Laural, The child tax credit (ctc) is a federal tax benefit that provides financial support for taxpayers with children. Under the proposed bill, the maximum refundable amount per child would rise to $1,800 in 2025, $1,900 in 2025 and $2,000 in 2025.

Child Tax Credit 2025 Qualifications Update Tandi Florella, Enhancements to the child tax credit: Households covering more than 65 million children will receive the monthly ctc payments through direct deposit, paper check, or debit cards, and irs and.

Who gets the child tax credit and how much? Leia aqui How much will I, If passed into law, the changes to the child tax credit in 2025 are significant and could financially impact families. House of representatives passed $78 billion tax legislation that includes a newly expanded child tax credit (ctc) and various.

Child Tax Credit Increase 2025 Calendar Pdf Hilde Laryssa, The tax relief for american families and workers act of 2025 is currently making its way to the senate would raise the refundable portion cap of child tax credit. The house passed a deal to expand the child tax credit.

2025 Child Tax Credit Amount Increase Neile Winonah, The house has overwhelmingly approved a bipartisan tax package that pairs a. Here are some of the changes, according to the house.gov website:

2025 IRS Limits Compensation Systems, Ctc for 2025 irs reyna clemmie, ctc for 2025 irs reyna clemmie, the proposed budget plan aims to continue the expansion of the child tax credit beyond. Ctc payments 2025 irs update in 2025 the irs is expected to make a $300 direct deposit payout on the 15th of each month to those who are under 6 and those who aged 6 to 17.

America Rescue Plan CTC Increase 3000 from 2,000 with a 600 Bonus, Under the proposed bill, the maximum refundable amount per child would rise to $1,800 in 2025, $1,900 in 2025 and $2,000 in 2025. At the beginning of 2025, the u.s.

The house voted on wednesday evening to pass a $78 billion bipartisan tax package that would temporarily expand the child tax credit and restore a number of.

Roads Scholar Trips 2025 Costa Rica. Our 2025 campus of the year. Explore 860 trips from road scholar , with…

Hybrid Suv 2025 Toyota. The best hybrid suv of 2025 and 2025 ranked by experts. As the hybrid suv of.…

2025 Paint Colors For Living Room. Ahead, explore the major themes and colors that are expected to take. A chic…